Yesterday, the Alberta Gaming, Liquor and Cannabis Commission (AGLC) announced that liquor markups in Alberta will increase as of April 1st 2025 for “high-value wine”. Liquor markups are government imposed fees applied at the wholesale level as a result of the statutory government monopoly over wholesale liquor distribution. Essentially, they are ‘hidden’ taxes on liquor. Previously, AGLC had applied a volume-based markup on wine, which now increases slightly to $4.11 per litre ($3.08 per 750 ml bottle). This fee remains constant regardless of the value of the wine. This system was often referred to as the ‘flat tax’ and was preferred by many in the industry as being relatively simple. It resulted in prices for wine that were relatively low by Canadian standards.

A new system has now been introduced that is more complicated and imposes additional fees on “high value” wines that are based on the value of the wine (sometimes referred to as ‘ad valorem’ taxes). The flat tax described above still applies for wines that have a “reference invoice price” up to $15 per litre ($11.25 per 750 ml bottle) (I call this “Supplier Cost” below) . Using approximate calculations that would translate to about $20 per 750 ml bottle at retail once the various fees are added in. So wines at or below that consumer price point should be relatively unaffected.

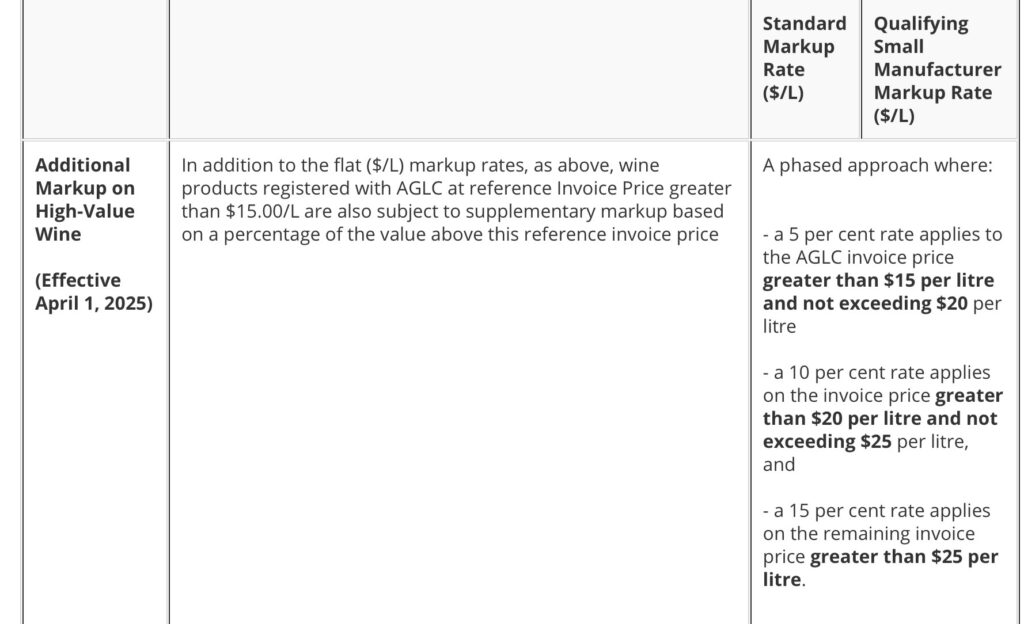

However, for wines above the $15 per litre reference point, there are new additional percentage based fees that are shown in the table below:

As you will note, this system is fairly complicated imposing 3 levels of additional fees, based on the wine’s value. The fees are 5% for value between $15-20 per litre. Then 10% for any value between $20-25 per litre. Then 15% for any value above $25 per litre. Again, using approximate calculations, this would have the following effects. Retail margins vary considerably so the numbers would change accordingly (examples below use a retail ‘markup’ of 38%).

| Supplier Cost inc. excise/duty (750 ml) | Flat Tax Markup | Additional ‘High Value’ Markup | Approx Wholesale Price | Approx End-Consumer Price | Approx Price Increase |

| 11.25 | 3.08 | 0 | 14.33 | 19.78 | 0 |

| 15.00 | 3.08 | 0.19 | 18.27 | 25.21 | 0.26 |

| 18.75 | 3.08 | 0.57 | 22.40 | 30.91 | 0.79 |

| 30.00 | 3.08 | 2.26 | 35.34 | 48.77 | 3.12 |

| 75 | 3.08 | 9.01 | 87.09 | 120.18 | 12.43 |

The new system will create end-consumer price increases as noted and which are more significant as the value of the wine increases. Any value (supplier cost) above $18.75 per bottle will be ‘taxed’ at 15% so the largest increases will occur for expensive wines (above approx. $30 retail). Effectively, Alberta has now introduced a new hidden ‘tax’ of 15% on expensive wine.

The new system becomes effective on April 1st, 2025. I note that it remains unclear how these changes will apply to the recently announced DTC registration system under which BC wineries can sell directly to consumers in Alberta.